When choosing regardless of whether to rollover a retirement account, you ought to meticulously think about your personal problem and Tastes. Information supplied by Beagle is just for general reasons and isn't meant to change any individualized recommendations so that you can observe a specific suggestion.

The utilizes of these kinds of entities are diverse. A Believe in fashioned prior to relationship is taken into account outside your marital estate. The assets are proof against divorce and create a prenuptial arrangement pointless. A Self-Settled Rely on can be the foundation of the estate strategy both now or in a while.

There are lots of kinds a Wyoming Asset Protection Have faith in usually takes. You can create a Rely on to provide all through your life span when supplying for Your loved ones afterward. They may be useful for minimizing taxes, proudly owning assets anonymously, shielding assets, and a lot more.

They're frequently attractive if a beneficiary, like your child, just isn't financially responsible or includes a drug challenge. In such situations, a Public Belief Business may well aid your children make smart investment selections.

We demonstrate the variances concerning two of the most typical varieties of everyday living insurance policies that will help you come to a decision what may very well be best for your needs.

Lowers Umbrella Coverage Expenses: The DAPT holds considerable assets spun off out of your businesses, which offers protection from major claims and lawsuits and tends to make an insurance plan coverage for these assets needless.

Each state's Believe in guidelines are diverse. You'll find states which tend not to allow for Self-Settled anti-creditor Trusts or do not have as advantageous of conditions. There exists small priority for a way courts shall decide when the regulations of states conflict.

You will find there's ten-calendar year glimpse-back interval for transfers to Asset Protection Trusts any time you go bankrupt. If you're uncovered to become deliberately defrauding an investor, then the assets from the Believe in won't be protected against bankruptcy proceedings for pop over to this web-site ten decades.

When you are like many, you might imagine that getting lifetime coverage demands a overall health Examination. Find out more about a simpler path to having existence insurance.

The place it will be if you move absent is any person's guess. Which is why it is sensible to strategy for an surprising lowering in the estate tax exemption even when It's not at all quickly necessary.

All investments have risk, and no investment method can warranty a profit or guard from loss of capital.

The Have confidence in is irrevocable, but modifications is often designed, including although not limited to adding and removing beneficiaries and trustees.

1) Protect your personal residence and financial institution account from liabilities including vehicle incidents or other functions personalized personal injury Lawyers really like.

They are really called unintended mainly because whenever you established every little thing up your intent was not to buy an vehicle accident or for 50 percent the money to drop by your child's ex-spouse. With suitable planning, you are able to "lock out" unintended beneficiaries.

You can easily select an present IRA custodian of the choice or in case you don’t have one particular, Beagle is teaming up with find out here top rated IRA providers to give you an market-main very low cost robo-advisory Alternative to bring you a far better way to you could try these out save for retirement.

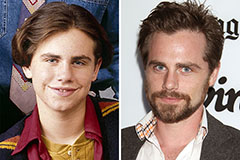

Luke Perry Then & Now!

Luke Perry Then & Now! Rider Strong Then & Now!

Rider Strong Then & Now! Christina Ricci Then & Now!

Christina Ricci Then & Now! Loni Anderson Then & Now!

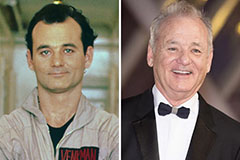

Loni Anderson Then & Now! Bill Murray Then & Now!

Bill Murray Then & Now!